Market Price Risk and the “Hockey Stick PPA”

Mar 21, 2016, By L. Marriott, S. Shander, and P. Natali (RMI)

In November 2015, more than 140 participants in the corporate renewable energy market gathered in New York City. They came together under the banner of RMI’s Business Renewables Center (BRC), a member-based platform that accelerates corporate renewable energy procurement. Last year, BRC-affiliated companies accounted for 88 percent of transactions. But to keep the market growing, remaining barriers must be removed. And according to the participants at the November conference, the most significant barrier is risk allocation—by a wide margin.

Of all the conceivable risks that are embedded in a power purchase agreement (PPA) transaction, market price risk is commonly cited as the main barrier to successfully completing a deal. Market price risk is defined as the uncertainty associated with market prices over the life of the PPA. The current contractual convention transfers the market price risk, in its entirety, from the financier, via the developer, to the off-taker in the form of a fixed price, often adjusted by a pre-defined price escalator. This convention relies on the rationale that the lender needs to secure specific debt-coverage ratios, while the equity investor meets a desired equity return.

However, this conventional PPA structure may not fit every buyer’s unique risk appetite. This is because buyers come in a variety of shapes and sizes, and market price risk is tolerated differently by each of them.

UNDERSTANDING RISK EXPOSURE

The differences in buyers’ market positioning, and therefore risk appetites, may be conceptualized along two dimensions.

First, buyers with few competitors may be primarily interested in fixing their energy cost so that it becomes a known, predictable, and stable variable, even if that means removing the potential to realize lower prices. Buyers in a highly competitive sector, on the other hand, may be interested in more closely managing (i.e., reducing) their relative energy cost to ensure cost competitiveness.

The second dimension is energy intensity, that is, energy cost as a percentage of total production costs. Energy-intensive industries will be more sensitive to the gap between the PPA price and the market price, because that price will have a larger impact on their total production cost.

DIFFERENT RISK APPETITES: ONE SIZE DOES NOT FIT ALL

The reality is that many current and future buyers operate in sectors that are both highly energy intensive and highly competitive. To them, a PPA is more than a fixed energy price: it must conform to their uniquely defined risk tolerance.

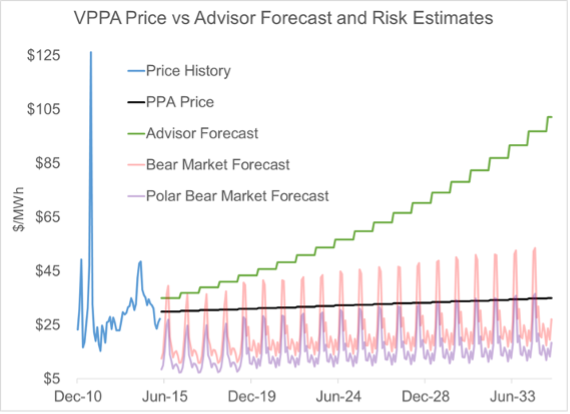

The problem is that a plain vanilla, fixed-price PPA implies a risk not every off-taker is willing to assume. This type of deal has been dubbed the “Hockey Stick PPA,” because the off-taker’s goal of managing their relative and absolute energy costs, as described above, is only achieved if the market price follows a trajectory that bends upward like a hockey stick, that is, an incrementally increasing trajectory. The chart below illustrates this concept, with the blue line representing the commonly provided forecast for long-term energy prices. One may suggest that going long at a fixed price “takes risk off the table,” but the reality is that one has simply exchanged one risk (rising prices) for another (falling prices). If a buyer ends up “long and wrong,” that buyer receives a fixed price while the market enjoys lower prices, thus creating a competitive disadvantage for an extended period of time. Again, this might be acceptable for some firms, but for the majority, it may end up doing more harm than good.

For the full article, click here.